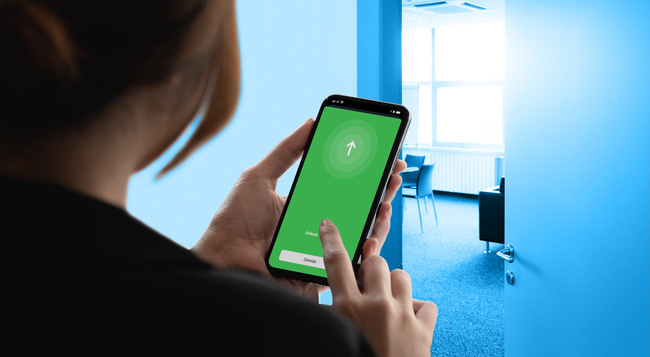

Revolutionary access control solution, Sentry Access uses advanced cloud-based software technology to provide secure, reliable, and convenient mobile access control without the need for electronic wired door readers. Unlike any other cloud-based access control solution on the market, Sentry Access takes an innovative spin on conventional mobile access whereby now the user’s phone acts as the reader and an unpowered NFC door tile acts in the same way as a traditional credential would.

Sentry Access is a cost-effective mobile entry solution for organizations to achieve enhanced user access experience and convenience through keeping a building’s legacy access control system or systems in place. In addition to not needing to ‘rip and replace’ existing access control hardware, Sentry Access’ readerless mobile access solution enables customers to cut costs by decommissioning legacy hardwired badge readers and systems.

The Sentry Access software can integrate with all major access control brand systems and unifies multiple disparate systems to provide centralized building access management through the Sentry Interactive app or SDK integration with a clients app. This means organizations with multiple offices can manage all the buildings in their portfolio just as easily as one. Onboarding and terminating users can be done via the app or portal from anywhere 24/7.

One of the main advantages of Sentry Access and mobile access credentials is that it eliminates the need for traditional access control systems, such as key cards, fobs, or pin codes. This means that users don’t have to carry any additional items or remember any codes, making the system much more convenient to use. With only one secure mobile credential necessary, a consistent user experience is created.

Additionally, as a cloud-based solution Sentry Access holds the ability to grant digital visitor passes remotely. This streamlines the check-in process by having the ability to grant access remotely to guests avoiding archaic paperwork, time and costs associated with physical visitor passes.

People are now entering a world of access control led by software and fueled by data, saving organizations time and money and offering valuable data insights. Sentry Access offers advanced reporting and analytics capabilities surrounding door unlock data to allow property managers to understand building usage to manage or report effectively.

As a readerless cloud-based solution Sentry Access ultimately provides scalability. By utilizing the building’s existing access control systems, integrating with the identity management platform, and the Sentry Interactive cloud infrastructure. Extra doors can be brought online remotely without needing to install extra readers or issue additional keycards and fobs. An ideal solution for both small offices and large corporate campuses’, providing a seamless and secure access control solution for any organization.

Learn more about Sentry Interactive’s readerless access control solution here.