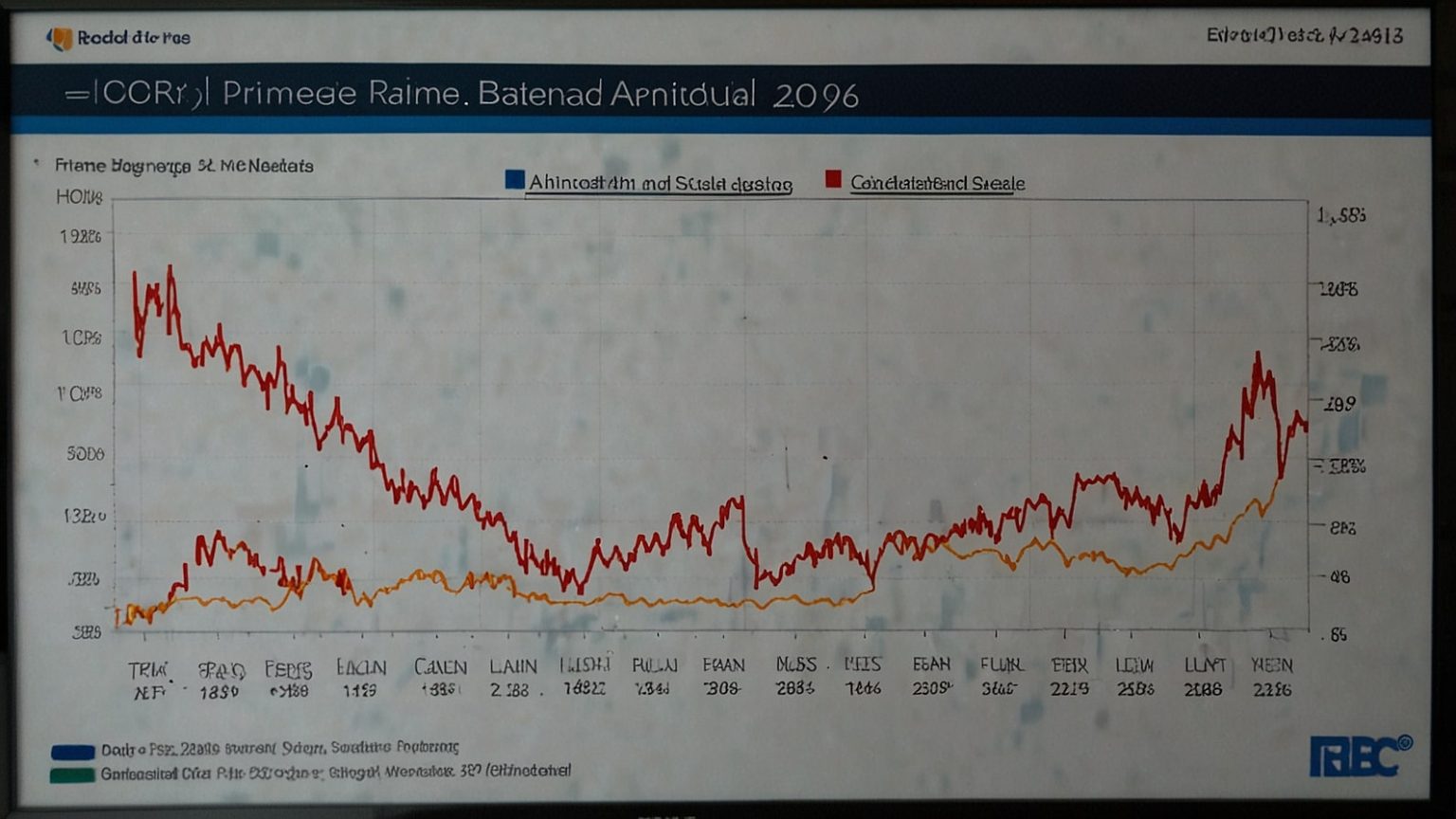

Toronto, September 22, 2025 – Royal Bank of Canada (RBC) has reduced its prime lending rate by 25 basis points to 4.70% today in a move that is shaking the housing market in Canada and beyond, with expectations now that mortgage renewals will be fast-tracked in quick succession to the aggressive easing cycle that the Bank of Canada has been undertaking.

The second change over the last several months, this one follows weakening labour data and puts RBC in a vanguard of the Big Six banks, which could open the door to billions of consumer spending dollars. With the TSX Composite just a point away from crossing 30,000 (up 0.8 per cent in early trading to 29,998), the turnaround in the financial industry is an indicator of a wider economic rebound, with the economists now forecasting a further three-point decline by the end of the year.

The interest rate cut has a direct effect of reducing the variable rate mortgage payments of millions of Canadians who are now relieved at a time when the cost of living is proving to be intractable. In a standard mortgage of $500,000, with a 25-year amortisation, the current tweak saves about 80 dollars a month, or more than 1000 dollars a year.

This is no mere figure adjustment; it is a lifeline to families who are desperately trying to make both ends meet due to the long arm of inflation, said a mortgage broker with 20 years in the business with a base in Vancouver.

This move by the RBC is in line with the 50-basis-point policy rate reduction made by the central bank in the previous month, whereby the overnight rate has risen to 3.75% and triggered a 1.2-per-cent lift-off in bank shares. RBC (TSX: RY) shares rose 1.1% to $168.50 and its competitors such as TD Bank (TSX: TD) and Scotiabank (TSX: BNS) rose 0.9 and 1.0, respectively, leading the financials sub-index to increase 1.3%.

Prime Rate Pivot: Why This Bodes Ill for Borrowers and Businessmen.

The move by RBC is indicative of a coordinated reaction to the deflation of inflationary forces and the employment market that is starting to crack- August recorded an unemployment rate of 6.4%, the highest since the end of 2018. A statement issued towards the end of last week by the bank highlighted its focus on aiding clients with purpose-based lending.

However, insiders indicate that strong internal indicators, including a 15 per cent decrease in loan loss provisions quarter-to-quarter and a maintained credit card delinquency rate of 1.2 per cent, suggest a more robust financial position. This strength enabled RBC to retain its full-year earnings forecast of $12.00 to 12.50 per share as the trade tension around the world is simmering.

To businesses, the reduced prime rate makes the pot even sweeter for the lines of credit and commercial loans, especially in the retail and real estate areas that are still recovering their lost footing due to the high cost of borrowing. The small and medium enterprises, which contribute 40% of the GDP of Canada, are likely to save up to 2% on the annual interest payments, according to the Canadian Federation of Independent Business estimates.

There is an improvement in expansion inquiries already, which is being registered, think franchise openings, inventory builds, said an RBC commercial banking executive in one of the media briefings. This is in line with the seasonal Malaise in back-to-school and holiday preparations, which could give Q4 GDP a boost in the range of 0.2 percentage points.

This isn’t isolated to RBC. Industry observers believe that TD and BMO will follow suit within a few days, as seen in the cascade effect over the past month. The cumulative effect may result in savings of up to $5 billion in the annual variable rate products, including home equity lines and auto loans. However, fixed-rate borrowers, now 70% of new originations, can not experience a sense of instant pain, as swap rates have fallen 40 basis points since July, alluding to sub-4% fixed offers of five years by October.

Housing Market Rebound: Renewals in the Spotlight

Things are turning in favour of the tormented housing industry in Canada. The prime cut would help prevent a flurry of payment shocks with 1.2 million mortgages due to renew within the next 6 months, with many of them doubling their rates to the current rates.

The Canadian Association of Mortgage Professionals estimates a 15 per cent increase in the refinancing business until Q1 2026 as borrowers lock in savings in advance of the possible U.S. election spillovers. This would stabilise the listings in Toronto and Vancouver, where the average home price is at 1.1 and 1.3 million dollars, respectively, and this will help reduce the 8% decrease in sales per year.

The personal banking division of RBC is accelerating with customised products: a new cash-back and fee-free switches to the variable rate are called the Renewal Boost, which should attract millennials and Gen Z homeowners. First 48 hours after announcement, Early uptake was 20,000 applications.

The new luxury, joked the head of the mortgages department at RBC, is affordability. According to the data on the stress-testing models provided by the bank, 85% of its clients would not feel pressed due to a further reduction in the points by 50 basis points, which helps to strengthen the hope of a soft landing of the sector.

The wider implications extend to real estate investment trust (REIT) funds, with RioCan (TSX: REI.UN) and Choice Properties (TSX: CHP.UN) surging 1.5% and 1.8%, respectively, on hopes of reduced capitalisation rates. The commercial vacancy is at 7.2 per cent. Countrywide could be reduced by developers who might access cheaper debt to convert office into residential- a move that RBC has funded to the tune of 2 billion dollars in the current fiscal year.

The Banking Industry Surviving Global Headwinds

The presence of a divergence in global cues is the backdrop of the manoeuvre of RBC. As the U.S Treasury yield slid down to 3.8% after the weak jobs report on Friday, European financial institutions struggle with ECB hawkishness.

The lenders in Canada, on their part, are on fire: Q2 net interest income throughout the industry increased 12 per cent year-over-year, supported by broad deposit spreads and fee development by wealth management. The company’s presence in 37 countries and its service to 19 million international customers dampens the volatility in the domestic market, as operations in the United States of America account for 25 per cent of earnings and experience 8 per cent revenue growth.

Sustainability permeates the story, also. RBC committed to green lending of 10 billion dollars last year, and today’s rate cut is connected to that spirit by subsidised loans to be used on energy-efficient retrofitting. According to MSCI, the bank is currently ranked second among its Canadian competitors in terms of ESG, with a sustainable inflow of up to $ 15 billion year-to-date.

The slogan was “We are not merely lowering rates, but we are investing in a strong future,” which earned 50,000 views on a LinkedIn post by CEO Dave McKay. Challenges linger, of course. The threat of cybersecurity is also imminent following a series of attacks on regional players, which has led RBC to spend $500 million on AI-based defences. Regulatory pressure on open banking, which is planned to be rolled out in 2026, has the potential to halve 5% of the fee income, but RBC pilot projects make it a market leader.

TSX Momentum: Financials Charge Home To 30K

The fact that TSX traded close to 30,000 is not accidental. Financials, a third of the index, has been behind 60% of its 24.72% year-to-year gain, beating materials and energy. That was added to today when the prime rate rocketed, and the total market capital of the banks in the initial hour had increased by an additional $12 billion. Tech and consumer discretionary also underperformed a bit, falling 0.2%, with investors switching to yield-intensive stocks with an average yield of 4.5%.

The futures indicate that the first breach of the peak of July will be 30,050, provided that the volume is sustained. Volatility is still low, with the S&P/TSX 60 VIX of 12.5, which is half of the March ratings. According to one CIBC Capital Markets strategist, the rate story is the North Star of the market. It drowns tariff clatter and holds the bulls in its grip.

On the light side, Enbridge (TSX: ENB) has issued an update on its Birch Grove pipeline expansion project. It is holding community open houses in Dawson Creek today to get feedback on the addition of 178 million cubic feet per day of natural gas capacity.

Its shares increased marginally by 0.3 to stay at $52.8,0, waiting to file the regulatory application in the second quarter of 2026. Shopify (TSX: SHOP), in the meantime, rose 0.5 per cent to $147.20 after the previous week’s announcements of international partnerships, which highlight the steady pace of e-commerce during the rate-driven spending spurt.

Prognosis: Endgame and Investor Plays of Easing

With the Bank of Canada meeting, well-anticipated on November 5, the month of October is next, and the markets are pricing the chances of another quarter-point reduction at 75% probability. By the middle of 2026, economists at RBC Economics predict that the policy rate will reach 2.75% before setting the path to 2% inflation and 1.5% GDP growth.

To an investor, this business climate is pro-dividend aristocrats such as RBC, which yields 3.8 per cent and has increased its dividend for 14 years in a row. The risks are a hotter-than-foreseen print of the CPI on Wednesday, which would slow the process of easing and trim the margins of banks.

Another option is the Jackson Hole redux of U.S. Fed chair Powell next week, which could also tune the expectations in the case of an intensification of tariff negotiations. Nevertheless, the fiscal buffers of Canada, such as a deficit of 1.1% of GDP, provide a moat on spillovers.

Today, 2011 rate repricing by the RBC is not merely fine-tuning in the financial market; it is a catalyst for a revival in homes, businesses and in the portfolio of homes as well. Canadian markets prove their worth as a safe haven in the stormy waters as the TSX continues to scale new heights. To savers and spenders, the message is clear: relief is at hand, and it can be followed by more. The financial machine runs well, driven by sound policy and strong players.