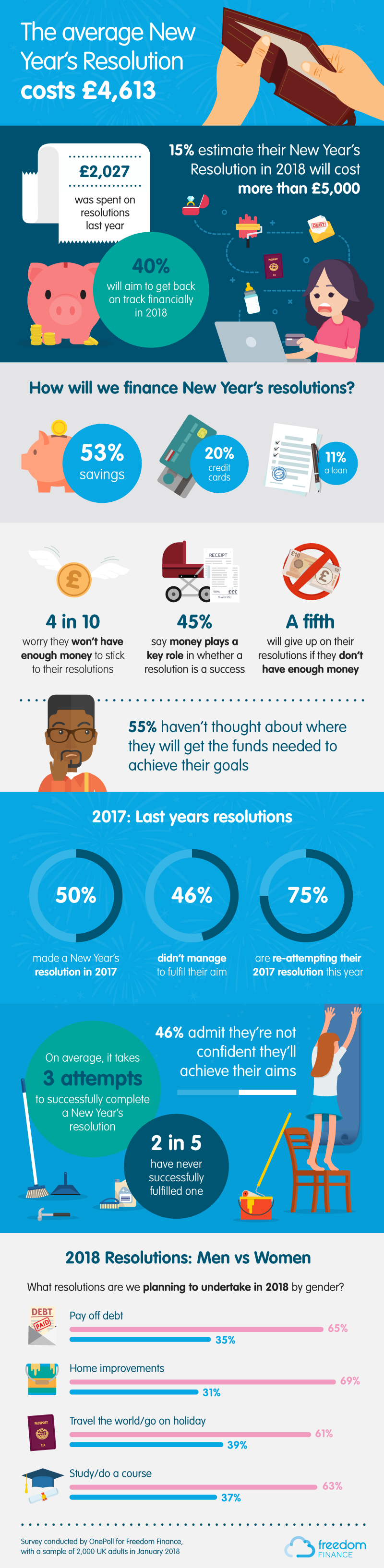

The average Brit will end up spending £4,600 trying to achieve their New Year’s resolutions

The average adult will shell out £4,600 on ‘financial’ New Year’s resolutions such as conquering their debts or moving house, according to a study.

Expensive pledges such as paying off debt, buying a car and travelling the world are just as popular as traditional resolutions such as quitting smoking.

The average person will attempt two such promises and reckon they will cost £4,612.52 to achieve, the poll of 2,000 people found.

But 46 per cent have already adopted a defeatist stance and admit they’re unlikely to achieve their aims.

On average it takes three attempts to successfully complete a New Year’s resolution – and almost two in five have NEVER successfully fulfilled one.

Commissioned by Freedom Finance, the research found four in ten are worried they won’t have enough money to stick to their resolutions.

Brian Brodie, CEO of Freedom Finance, said: “We all know that motivation plays a key part in making a New Year’s resolution successful, but sometimes we overlook other important factors such as cost.

“The cost of resolutions for the year ahead such as having a wedding, buying a house or travelling, can soon mount up, and can often lead to people giving up on their resolutions or delaying them until the following year.

“Planning ahead and creating a budget for your resolutions in advance can help to increase the chances of achieving your goals.”

Forty-five per cent said money plays a key role in determining whether a resolution is a success or a failure.

And more than one fifth revealed they will give up on their resolutions if they don’t have enough money to complete them.

But despite this, 55 per cent haven’t thought about where they will get the funds needed to achieve their goals.

Of those polled, 11 per cent will however rely on a loan to cover the costs of their aims, around one fifth will depend on credit cards and 53 per cent will use their savings.

Carried out through OnePoll.com, nearly half of those polled made a New Year’s resolution in 2017 – spending £2,026.75 in the process.

However 46 per cent didn’t manage to fulfil their aim – and for 28 per cent cost was a factor.

Undeterred, three quarters of respondents are re-attempting their 2017 resolution this year.

The research also found 11 per cent of those aged under 25, along with 15 per cent of over 55s, want to clear their debts and get back on track financially over the next 12 months.

Brian Brodie added: “Post-Christmas, people are starting to realise the extent of their spending from the festive period and previous year.

“With the New Year comes a fresh start, so it’s natural that people want to find a way to better manage their finances and get back on track.

“We usually see an increase in demand for debt consolidation loans in January.

“They can be a popular choice as it can help the customer to group all of their existing borrowing, making their monthly repayments easier to manage.”