Firstcapital1 Review: Get started in online trading with this top broker!

What is Online Trading?

Online trading is the process of buying and selling securities, such as stocks, bonds, and other investment products, through an online broker. Online trading platforms offer investors a variety of features, such as the ability to research and place trades, as well as access to real-time market data.

For starters, online trading platforms offer investors a convenient way to research and place trades. In addition, online trading platforms provide access to real-time market data, which can be a valuable resource for making investment decisions.

Another advantage of online trading is that it can help you save money on commissions and other fees. When you trade online, you can often do so at a lower cost than if you were to trade through a traditional broker.

Of course, there are also some risks associated with online trading. For example, it’s important to be aware of the potential for fraud. And, as with any type of investing, there’s always the potential for loss.

However, if you’re careful and do your homework, online trading can be a great way to grow your investment portfolio.

How to Choose the Right Online Trading Platform

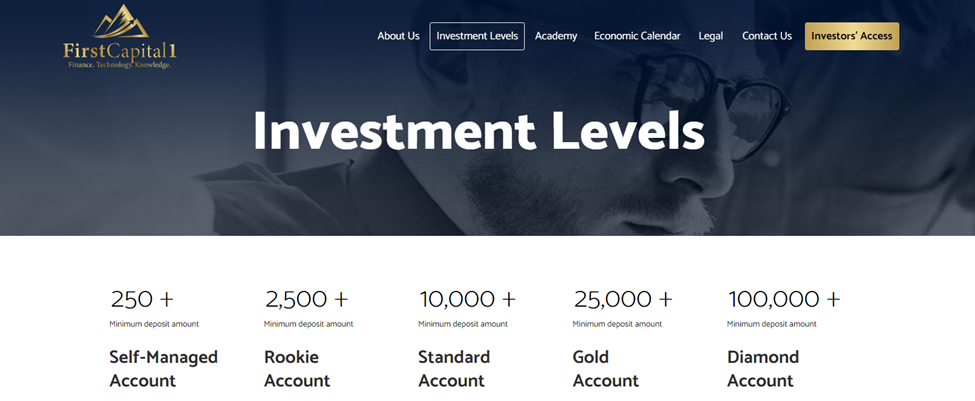

Now that you know what online trading is, you may be wondering how to choose the right platform for your needs. There are a few things you’ll want to keep in mind, such as the fees charged by the platform, the types of securities offered, and the platform’s user-friendliness.

When it comes to fees, you’ll want to make sure you’re not being charged more than you need to be. Many online trading platforms charge a commission on each trade, so you’ll want to find one that charges a low commission. Some platforms also charge a monthly or yearly fee, so you’ll want to factor that into your decision as well.

The types of securities offered by a platform is also an important consideration. If you’re only interested in stocks, then you won’t need a platform that offers a wide range of securities. However, if you’re interested in investing in other types of securities, such as bonds or mutual funds, then you’ll want to make sure the platform you choose offers those types of securities.

Finally, you’ll want to consider the platform’s user-friendliness. Some platforms are more user-friendly than others, so you’ll want to find one that’s easy to use. You should also make sure the platform offers customer support in case you have any questions or problems.

By keeping these factors in mind, you should be able to find the right online trading platform for your needs.

The Trading Platform:

FirstCapital1.com is an online trading platform that offers a variety of features and tools for investors. The platform offers a wide selection of securities, including stocks, bonds, ETFs, and more. The platform is also user-friendly, with a simple and intuitive interface.

FirstCapital1.com is a great platform for investors of all levels of experience. The platform offers a wide selection of securities, making it easy to find the right investment for you. The platform is also user-friendly, with a simple and intuitive interface. FirstCapital1.com is a great choice for investors who are looking for a user-friendly platform with a wide selection of securities.

The global financial markets are in a state of flux. For the past few years, traditional trading services have been slowly phasing out. In their place, online trading is becoming the primary form of trading.

This trend is only going to continue in the years to come. Financial analysts predict that eventually, all global markets will open up their services to new traders. This means that anyone with an internet connection will be able to trade stocks, bonds, and other securities.

FirstCapital1 is already ahead of the curve. They allow new traders to register an account with them and start trading right away. This is fantastic news for anyone who wants to get started in the world of online trading.

There are many benefits to online trading. First of all, it is much more convenient than traditional trading. You can do it from anywhere in the world, at any time of day or night.

Another big benefit is that you have access to a much wider range of securities. In the past, if you wanted to trade stocks, you would have to go through a broker. Now, with online trading, you can trade any security that is traded on a major exchange.

Finally, online trading is much cheaper than traditional trading. Brokers charge high fees for their services. With online trading, you only have to pay a small commission to the exchange. This can save you a lot of money in the long run.

If you are interested in getting started in online trading, FirstCapital1 is the perfect place to start. They offer a great platform for new traders, and they have some of the lowest commissions in the industry.

Conclusion:

When it comes to trading, there are a lot of things that online platforms have to offer which makes it a great option compared to the traditional way of trading. In this Firstcapital1 review, we have discussed some of the advantages that online trading has to offer. One of the biggest advantages of online trading is that it offers a lot of flexibility. You can trade whenever you want and from anywhere you want.

All you need is a computer and an internet connection. This is perfect for people who are always on the go or for those who don’t have the time to go to a physical trading floor.

Disclaimer: This article is not intended to be a recommendation. The author is not responsible for any resulting actions of the company during your trading experience.