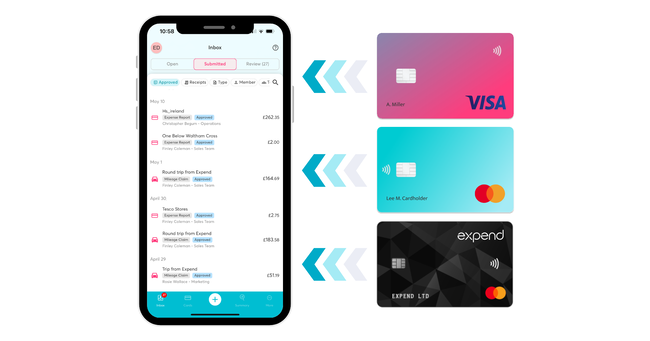

Expend, a leading digital platform for business expense management, has recorded a surge in adoption of its innovative ‘Card Connect™’ feature. Expend is the first UK platform to integrate expense data from Mastercard and Visa transaction feeds into its expense management capabilities.

With ‘Card Connect’, Expend’s clients now enjoy real-time expense settlement, allowing for more efficient financial management and time savings.

Johnny Vowles, CEO of Expend, said: “Card Connect has two important attributes. It enables companies to connect all of their business cards to our single platform, which has multi-card acceptance. This means that users can view and submit all of their expense claims in one app, whether, for example, they paid on their corporate Barclaycard or business HSBC card.

“The second is that these card payments can be viewed in the app instantly, as they happen. There is no wait time between making the payment and seeing it in the Expend app.”

Vowles continued: “Employees can charge their business expenses to a Visa or Mastercard, and by linking these cards to Expend, the transaction is processed immediately. Receipts can be attached, the expense categorised, and it can be submitted for approval via the app as soon as the purchase is made. For instance, an expense for team coffees can be logged and submitted by the time the drinks are ready.”

He added: “Managers and finance teams can view submitted expenses from various cards on a single platform, streamlining approvals and accounting reconciliation. This simplifies the process by removing the need for multiple logins and banking apps.”

Vowles also pointed out the issues with traditional methods: “Traditional expense management is an ‘eye roll’ moment for firms of all sizes, and their employees. Paper-based receipts, clunky claims processes, and long sign-off routines create headaches and delays for finance teams and colleagues. However, with Expend’s Card Connect, we are continuing to revolutionise the expense management market.”

He added: “Clients appreciate the flexibility in card choice, such as using business cards that accumulate travel points or other rewards. Expend’s card-agnostic platform means that managers can continue using their preferred credit options while registering them with Expend seamlessly.”

Usually, business credit card payments are centrally managed by finance teams, which involves matching transactions with bank records—a process that can be time-consuming. Expend’s Card Connect eliminates this burden and reduces the risk of manual input errors.

Vowles elaborated: “With Card Connect, whenever a Mastercard or Visa Business Credit or Debit card is linked to the company’s Expend account, the recipient will receive a notification to upload the receipt and submit it via the Expend app.”

He concluded: “Expend Card Connect continues our mission to improve real-time visibility and zero-touch processing of personal expenses, addressing a crucial customer need.”