Stocks May Tumble As Global Recession, Earnings Slump Hits: Boockvar

- Investors are excited about the Fed ending interest-rate increases and inflation slowing down.

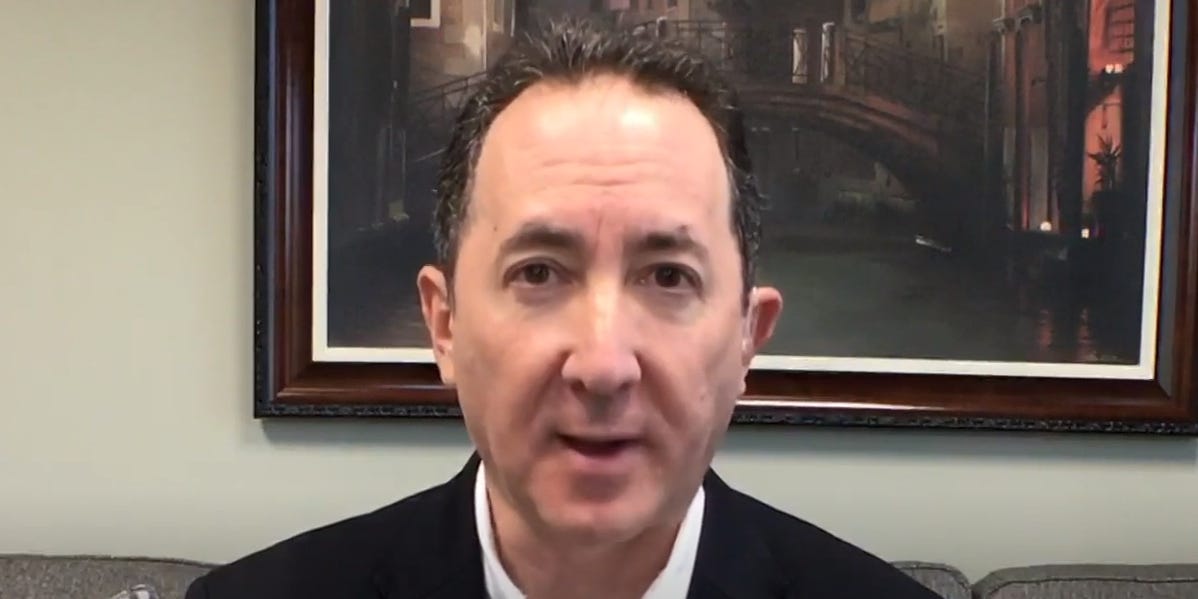

- Peter Boockvar stated that stocks could be affected by a global recession or earnings weakness.

- Bleakley Advisory chief has warned that some US housing markets could see a 20% drop in home prices.

Investors are embracing signs of slowing inflation and the possibility that the Federal Reserve will change from increasing interest rates to decreasing them. Peter Boockvar says they are not considering the potential impact on stocks by a global economic downturn, and a slump of company earnings.

Bleakley Advisory’s chief investors stated that “the market’s riding on the hope, belief, and inflation rolling over.” told CNBCFriday. The S&P 500, Nasdaq Composite, and Dow Jones Industrial Average each gained nearly 2% last week, reversing a small portion of their sharp declines this year.

Inflation reached 40-year highs in this year’s United States. This led to the Fed raising rates from almost zero to around 4.4% to stop price increases. Higher rates discourage spending, borrowing, and hiring — and that means they tend to weigh on asset prices, employment, and economic growth.

Boockvar stated that the prospect of rates rising and falling earlier than expected is “creating lots of relief, since we know inflation has been the main pain point in markets this year,” Boockvar.

He said that investors seem to ignore any concerns about the effects of rate hikes on the US and the potential damage that a global recession could do to corporate profits.

He said, “That’s the next mountain to climb for the market.” “That’s the next hurdle to overcome and the next leg for bear markets.”

Bleakley’s chief economist expects a drop of global demand to hurt companies’ earnings, and pull down stock prices. This will be offset by the boost they get from a positive rate outlook.

Boockvar has been warning about rate hikes and the US economic downturn for some time. He recently warnedThe nation’s most popular real-estate market could see house prices plunge 20%. This is because higher rates have pushed mortgage interest rates skyward this past year, making it more expensive to buy a home.

He also cautioned that a housing slowdown could have knock-on effects for consumer spending and economic expansion, given the sector’s enormous size and immense importance.

[Denial of responsibility! newsanyway.com is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – at newsanyway.com The content will be deleted within 24 hours.]